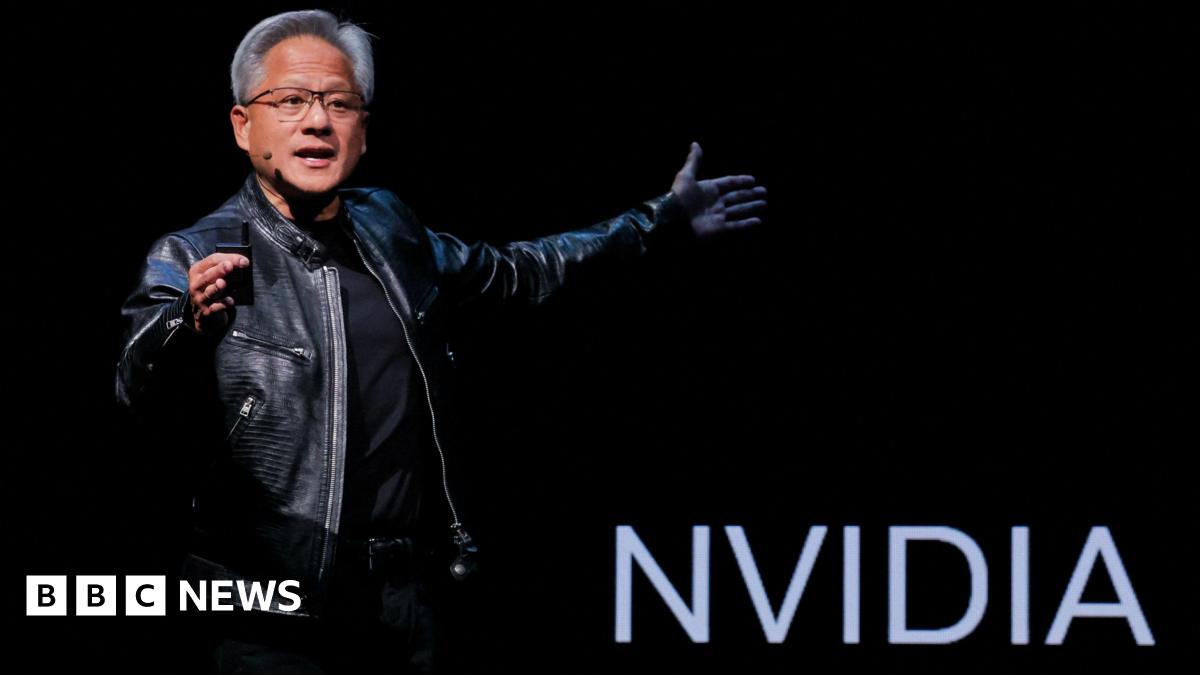

The world’s most valuable company – the biggest winner in the AI spending spree – has soared past its rivals in the technology sector.

It has struck deals with leading AI companies including OpenAI and Oracle as its chips continue to power the AI boom.

Nvidia’s value now exceeds the GDP of every country except the US and China, according to data from the World Bank, and is higher than entire sectors of the S&P 500.

Microsoft and Apple have also recently crossed the $4tn valuation mark, reinforcing a broader tech rally fuelled by optimism on Wall Street about AI spending.

AI-related enterprises have accounted for 80% of the stunning gains in the American stock market this year.

But concerns about an AI bubble – and whether these companies are overvalued – continue to mount as tech stocks hit record after record.

Warnings have come from the Bank of England and the International Monetary Fund, as well as from JP Morgan boss Jamie Dimon, who told the BBC that “the level of uncertainty should be higher in most people’s minds”.

Danni Hewson, head of financial analysis at AJ Bell, called Nvidia’s $5tn valuation “a sum so vast the human brain can’t properly get a handle on it”.

“Of course, this is going to do nothing to dispel fears over an AI bubble, but the market seems keen to march on regardless,” she added.

Some sceptics are now publicly asking whether the rapid rise in the value of AI tech companies may be, at least in part, the result of what they call “financial engineering”.

Leading AI firms have been investing in one another, creating a tangled web of deals that has been drawing scrutiny.

For example, OpenAI, which brought AI into the consumer mainstream with ChatGPT in 2022, last month secured a $100bn investment from Nvidia.