Introduction: Bank of England expected to cut interest rates today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The wise men and women at the Bank of England could bring gifts for borrowers today, in an attempt to stave off a UK economic downturn.

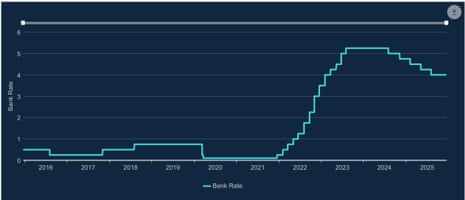

The BoE is widely, and confidently, expected to cut UK interest rates at noon, from 4% to 3.75%. That would take borrowing costs down to their lowest level since January 2023.

The money markets indicate there is a 97.5% chance of a quarter-point rate cut, and only a 2.5% possibility that rates are left at 4%.

Wednesday’s drop in inflation, to 3.2%, suggests the cost of living squeeze is easing, which could reassure BoE policymakers that the consumer prices index is heading back towards its 2% target.

More worryingly, Tuesday’s rise in unemployment to a new five-year high suggests the UK needs easier monetary policy, especially as wage growth slowed too.

With the economy shrinking in October, investors are confident that at least five of the Bank’s nine policymakers will plump for a rate cut.

Sanjay Raja, Deutche Bank’s chief UK economist, says:

With disinflation progress on track, the labour market showing added signs of loosening, and GDP growth missing expectations, a Christmas rate cut looks all but certain.

More rate cuts will likely follow in 2026. But much will depend on forward looking indicators of price pressures – including firms’ CPI expectations, price expectations, and wage expectations – and the evolution of the labour market.

Lingering weakness in the quantities side of the labour market could elicit a more dovish reaction function in 2026.

In a busy day for central bankers, we’ll also get decisions from Norway, Sweden and across the eurozone – they are all expected to leave interest rates on hold, though.

The agenda

-

8.30am GMT: Sweden interest rate decision

-

9am GMT: Norway interest rate decision 9am

-

12pm GMT: Bank of England interest rate decision

-

1.15pm GMT: European Central Bank interest rate decision

-

1.30pm GMT: US inflation report for November

-

1.45pm GMT: European Central Bank press conference

Key events

ING: Bank of England deeply divided, but rate cut expected

Today’s decision isn’t expected to be unanimous; indeed, it could be another 5-4 vote.

That’s because the Bank’s monetary policy committee consists of four dovish committee members who worry about the weaker jobs market and slowing wage growth, and four hawks concerned about supply-side constraints in the economy and inflation persistence, plus likely swing voter Andrew Bailey.

But unlike in November, when five policymakers wanted to hold interest rates and only four favoured a cut, those numbers could flip at noon today.

Bailey is most likely to shift from the hawks to the doves, economists believe.

James Smith, ING’s UK economist, explains:

Stuck in the middle of it all is Governor Andrew Bailey. He sits between those two camps and almost certainly holds the deciding vote this week. Crucially, though, he wrote in the November meeting minutes that he has more sympathy with the doves.

It sounded like he was edging towards voting for a cut last month, but wanted more evidence that inflation was coming down. On the basis that inflation has largely come in line with the Bank’s forecasts since then, and if anything a tad below, we suspect he will favour a cut this week. That sets up a 5-4 vote in favour of lowering rates to 3.75%.

Introduction: Bank of England expected to cut interest rates today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The wise men and women at the Bank of England could bring gifts for borrowers today, in an attempt to stave off a UK economic downturn.

The BoE is widely, and confidently, expected to cut UK interest rates at noon, from 4% to 3.75%. That would take borrowing costs down to their lowest level since January 2023.

The money markets indicate there is a 97.5% chance of a quarter-point rate cut, and only a 2.5% possibility that rates are left at 4%.

Wednesday’s drop in inflation, to 3.2%, suggests the cost of living squeeze is easing, which could reassure BoE policymakers that the consumer prices index is heading back towards its 2% target.

More worryingly, Tuesday’s rise in unemployment to a new five-year high suggests the UK needs easier monetary policy, especially as wage growth slowed too.

With the economy shrinking in October, investors are confident that at least five of the Bank’s nine policymakers will plump for a rate cut.

Sanjay Raja, Deutche Bank’s chief UK economist, says:

With disinflation progress on track, the labour market showing added signs of loosening, and GDP growth missing expectations, a Christmas rate cut looks all but certain.

More rate cuts will likely follow in 2026. But much will depend on forward looking indicators of price pressures – including firms’ CPI expectations, price expectations, and wage expectations – and the evolution of the labour market.

Lingering weakness in the quantities side of the labour market could elicit a more dovish reaction function in 2026.

In a busy day for central bankers, we’ll also get decisions from Norway, Sweden and across the eurozone – they are all expected to leave interest rates on hold, though.

The agenda

-

8.30am GMT: Sweden interest rate decision

-

9am GMT: Norway interest rate decision 9am

-

12pm GMT: Bank of England interest rate decision

-

1.15pm GMT: European Central Bank interest rate decision

-

1.30pm GMT: US inflation report for November

-

1.45pm GMT: European Central Bank press conference