Key events

Stellantis shares fall 12%

After that stalled start, Stellantis shares have tumbled 12% at the start of trading in Milan after announcing a €22bn charge as it scales back its electric car ambitions.

Stellantis taking €22bn charge as it scales back electric car push

European carmaker Stellantis is taking a €22bn charge, and admitted it overestimated the speed of the transition to electric cars.

Stellantis, whose brands include Vauxhall, Opel, Citroën, Chrysler and Fiat, is scaling back its push into electric vehicles as it aligns with “the real-world preferences of its customers”.

The huge charge reflects the heavy costs for writing off electric car projects. And investors aren’t impressed – Stellantis’s shares failed to start trading in Milan a moment ago, but are expected to fall 15% once trading begins….

It includes a €14.7bn charge for “re-aligning product plans with customer preferences and new emission regulations in the US”, where Donald Trump has been rolling back Biden-era emission regulations and incentives to encourage electric vehicle take-up.

Stellantis insists it will be at “the forefront” of elecric car development, but argues that it must be “governed by demand rather than command”.

Stellantis CEO Antonio Filosa says:

“The reset we have announced today is part of the decisive process we started in 2025, to once again make our customers and their preferences our guiding star.

The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires. They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new Team.”

There’s little reason to expect of either a renewed house price boom or a sharp correction in 2026, argues Martin Beck, chief economist at WPI Strategy, said:

Beck says the housing market is finely balanced, adding:

“Mortgage rates should continue to edge lower as the impact of past Bank of England rate cuts feeds through, with further reductions increasingly likely.

After a notably dovish February statement from the BoE [yesterday], the next cut could come as soon as next month. At the same time, easing inflation is supporting real wage growth, even as pay rises cool in cash terms.

That widening gap between regions of the UK is likely to continue, predicts Emeritus Professor Joe Nellis, economic adviser at accountancy and advisory firm MHA.

London and much of the South East continue to underperform, with price growth constrained by stretched affordability and a larger exposure to higher-value transactions.

In contrast, several parts of the Midlands, the North of England, Scotland and Northern Ireland are showing greater growth. Lower average prices, stronger rental demand and relative affordability are supporting firmer price growth in these areas, a trend that is likely to persist in the months ahead.

Prices falling in southern England

Halifax also report that the regional differences in house price changes have become more pronounced, with prices falling in the south of England.

There is “a clear divide” between the northern and southern parts of the UK, they report, with positive momentum carrying over in the North.

Today’s house price data shows:

Northern Ireland continues to lead the UK, with average prices rising +5.9% annually to £217,206.

Scotland follows closely, recording annual growth of +5.4%, taking the average property price to £221,711.

Wales saw a modest rise of +0.5% over the year, with the average home now costing £228,415.

Within England, the strongest growth remains concentrated in the north, with prices softening in the south.

The North West saw prices increase +2.1% to £244,328, while the North East recorded +1.2% annual growth.

The South East, South West, London and Eastern England all saw annual declines of more than 1%.

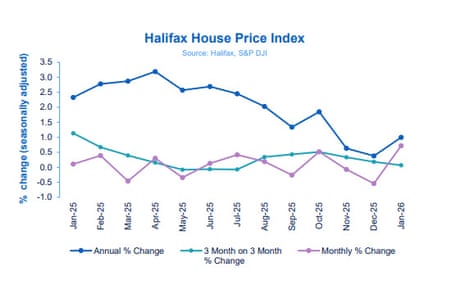

Introduction: Fastest jump in UK house prices in over a year

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have risen at their fastest monthly pace in over a year in January as the housing market steadied, lender Halifax has reported.

Halifax’s latest house price index shows that the average UK house price increased by 0.7% in January, more than wiping out December’s 0.5% fall.

That’s the fastest monthly increase since November 2024, and this lifts the average property price, on Halifax’s index, to a new all-time high of £300,077.

[that’s higher than the Office for National Statistics’ data, which pegs the average home at £271,000].

On an annual basis, prices were 1% higher than in January 2025.

Although the Bank of England left interest rates on hold yesterday, it is expected to cut borrowing costs perhaps twice this year, which could help borrowers.

Amanda Bryden, head of mortgages at Halifax, said:

“The housing market entered 2026 on a steady footing, with average prices rising by +0.7% in January, more than reversing the -0.5% fall seen December. Annual growth also edged higher to +1.0%, pushing the cost of the typical UK home above £300,000 for the first time. “While that’s undoubtedly a milestone figure, and activity levels show a resilient market, affordability remains a challenge for many would-be buyers.

“Broader economic conditions continue to provide some support. Wage growth has been outpacing property price inflation since late 2022, steadily improving underlying affordability. That’s a positive trend for buyers, and the long-term health of the market.

“And we’re now seeing more mortgage deals below 4%. If inflation continues to ease, there should be further gradual reductions as the year goes on. “All in all, we still think house prices are likely to edge up between 1% and 3% this year.”

The agenda

-

7am GMT: Halifax house prices index

-

7am GMT: German industrial production for December

-

1.30pm GMT: Canadian non-farm payroll report for December

-

3pm GMT: University of Michigan’s consumer confidence report